Digital Banking

Keep Windsor Federal at your fingertips to transfer funds, pay bills, deposit checks and more – anytime, anywhere.

How to stay safe and secure when you bank online.

Cybercriminals prey on people’s fears about health and safety. That’s just one example of email, text, and voice phishing scams that cybersecurity experts continue to warn about. Here’s how to protect yourself when you bank online.

At Windsor Federal Bank, we can’t stress it enough: Never give away personal information, such as social security numbers, checking account or credit card numbers, or PINs. And remember that a legitimate company would never ask for your online banking information, including username and password. Please remember that Windsor Federal will never contact you and ask for personal information. Do NOT give out any information over the phone.

Business owners face many challenges in today’s economy. Labor shortages and inflation make headlines daily, yet there’s one growing business issue we don’t hear about as much: Business bank fraud.

When fraud does occur, it can be hard to figure out what to do next. Many business owners believe that when a fraudulent transaction hits a business checking account, their bank will reimburse them in the same manner as a consumer account. But that’s not the case.

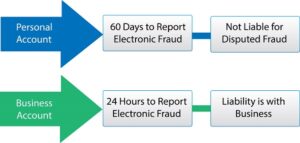

If you’re a business bank account holder, you have a smaller window of time than consumers to report fraud. You also have more liability and less protection. For example, personal account holders have up to 60 days to report a case of electronic payment fraud to their financial institution.

Businesses have only 24 hours to report electronic payment fraud, including unauthorized ACH transfers.

Know the Rules for Reporting Fraud

Consumer and business bank account protections are governed by different rules and restrictions. Consumer electronic transactions fall under Federal Reserve Regulation E (12 C.F.R. Part 205) and National ACH Association (NACHA) rules. These rules remove the consumer from liability for unauthorized transactions if they dispute the fraud within a reasonable timeframe. They also ensure reimbursement of lost funds from fraudulent activity or unauthorized ACH transfers.

Business clients don’t have the same protections. Federal protection for businesses that experience ACH fraud falls under the Uniform Commercial Code (UCC), which places the burden on the business to notify the financial institution immediately if there’s a disputed transaction. Remember:

After 24 hours, all liability for reporting fraudulent transactions shifts to the business.

Be Proactive in Protecting Against Fraud

With check fraud being one of the most common ways fraudsters can gain access to your funds, it’s important to take proactive steps to protect your business.

Windsor Federal offers a number of cash management products and services to help mitigate fraud on business bank accounts. It’s worth setting up time to speak with our Cash Management Team about how these products and services can be implemented for your business. In the meantime, here are a few simple steps you can take to help reduce your risk of being impacted by fraud:

Data Collection. When you visit our website to view pages or read product information, you do so without telling us who you are or revealing any personal identifying information. Our servers collect standard non-identifying information about site visitors, such as date and time you visited, your Internet service provider, the website that referred you to us, if any, and the page or pages you requested. While we do not collect identifying information about site visitors, we do collect data to track site activity. This information provides insight on how many people use our website, which areas of the site are most popular, and how to improve site functionality.

External Site Links. The Windsor Federal Bank website contains links to community and other websites that are not affiliated with the bank and are not third-party vendors of the bank. While we provide the links to such external sites, we cannot assume responsibility for the privacy practices or content of such sites.

Personal Information. At times you may voluntarily provide us with personal identifying information. For example, if you complete a feedback form or send us an email, you’re transmitting information you choose to include. We can only collect personal information if you elect to send it to us. Please do not send sensitive information through our request forms or by email as our request forms are not secure, and email transmissions through general or public email are not secure. Whenever we collect personal identifying information, we use it only to fulfill your request, to respond to your comments or questions, or to contact you directly.

We do not give or sell your information to anyone, and we protect the security and confidentiality of the information we collect.

Note: If you visit our website to use online banking tools such as financial calculators, you may be asked to provide personal information to complete your request. This information is not retained. If you send an email or fill out online applications, check reorder forms, or contact forms, you may be asked for identifying information to process your request. This information may be retained by us and our business partners to facilitate processing. We treat this information no differently than information you might provide in a written format.

Encryption Technology. Information transmitted to and from Online Banking or our online bill payment service is secure and used only for the normal processing of your account(s). Online Banking uses state-of-the-art encryption technology to ensure the security of your account information. Encryption is the method of encoding data so only those who know the code can translate it into understandable information. Online Banking uses very strong encryption to safeguard your account information. When you send data via Online Banking, your browser translates it into a mathematical code before transmitting it to our system. Once the system receives this code, it’s translated into information we can use.

Confidentiality and Security. To use Online Banking, you must enter your user ID and password at the start of every session. The password is assigned solely to you, and you are responsible for keeping it confidential to prevent unauthorized access to your accounts or the Online Banking service. We recommend keeping your user ID and password in a secure location separate from your computer and changing your password frequently. Never leave your computer unattended, especially while logged into Online Banking.

Online Banking Email. Online Banking email is secure, so you may send sensitive account or personal information via the Online Banking site. However, please use Online Banking email only for inquiries associated with Windsor Federal Bank’s Online Banking and online bill pay services.

About Our Privacy and Security Statement. We protect and safeguard the privacy of our online services users, just as we do throughout the rest of our business. We will use your personal information only to identify you, communicate with you, and help us answer your questions. If in the future, we find it necessary to change our information sharing practices in any way that differs from this policy statement, we will notify you in advance of any change.

At Windsor Federal Bank, maintaining your trust and confidence is our highest priority. We want you to understand how we collect and use information about you and the measures we take to safeguard your identity. If you have questions related to this statement, please contact our Customer Service Department at 860.688.8511 or the branch manager at any of our branch office locations.

Please notify the bank if you will be traveling outside Connecticut or the United States. If you are overseas and lose your ATM/Debit MasterCard® or your card stops working, please contact us immediately.

ATM Card/Debit MasterCard®

860.688.8511 (during business hours)

800.264.5578 (after hours)

Lost/Stolen Checkbook, Identity Theft, Suspected Fraud, Online Security, General Security

860.688.8511